Restructuring/Re-profiling

Strategic guidance for distressed businesses, maximizing returns and managing risk.Bridge Factor specializes in reorganization services, providing comprehensive advice and assistance to underperforming and financially distressed businesses. Our tailored turnaround plans, backed by rigorous financial analysis and strategic recommendations, empower management to regain control, manage crises, and optimize returns for creditors while minimizing risk exposure. From independent financial analysis to negotiation support and corporate structure optimization, we offer a holistic approach to restructuring, ensuring sustainable recovery and long-term viability.

Tailored Turnaround Plans

Proven methodologies to develop customized turnaround plans, maximizing efficiency and minimizing risk exposure for distressed businesses.

Financial Analysis

Independent financial analysis to assess performance and identify areas for improvement, providing actionable insights for informed decision-making.

Creditor Recommendations

Providing recommendations to creditors, facilitating negotiations, and optimizing outcomes for all stakeholders involved in the restructuring process.

Operational Efficiency

Examining company/group structure to enhance efficiency, reduce operational costs, and minimize risks to the organization.

Debt Negotiation

Expert assistance in negotiating debt, whether raising new finance or renegotiating existing facilities, ensuring robust financial support and resilience against potential challenges.

Transactions History

SME Bank Valuation

Financial Advisory To BMA Capital for Privatization Commission services included Review of loan portfolio and valuation of the bank under different scenarios Transaction Value USD 50.5 Million BMA Capital

To BMA Capital for Privatization Commission services included Review of loan portfolio and valuation of the bank under different scenarios Transaction Value USD 50.5 Million

Read More

Privatization of SME Bank

Financial Advisory to Privatization Commission of Pakistan For the divestment of GoP's shares in SMEBank. Services included transaction structuring, due diligence, valuation, and bidding Abandoned by Privatization Commission For Privatization Commission

Financial Advisory to Privatization Commission of Pakistan For the divestment of GoP's shares in SMEBank.

Read More

Privatization of First Women Bank Ltd

Task include due diligence, marketing and biding documents, valuation, marketing and sale through competitive process

Task include due diligence, marketing and biding documents, valuation, marketing and sale through competitive process

Read MoreOur Team

Abbas Haider

Engineer Information Technology (IT)

Islamabad, Pakistan

Abbas is Highly seasoned and have achieved Degree in Electrical Computer Engineering with deep and broad proficiency in all types of corporate IT. Strong and accessible presenter of difficult and complicated material to a variety of professional and non-professional audiences. Able to function well independently or as part of a team. Also a skilled leader who has the proven ability to motivate, educate, and manage a team of professionals to build software and hardware programs and effectively track changes. Confident communicator, strategic thinker, and innovative creator to develop software and hardware that is customized to meet a company’s organizational needs, highlight their core competencies, and further their success.

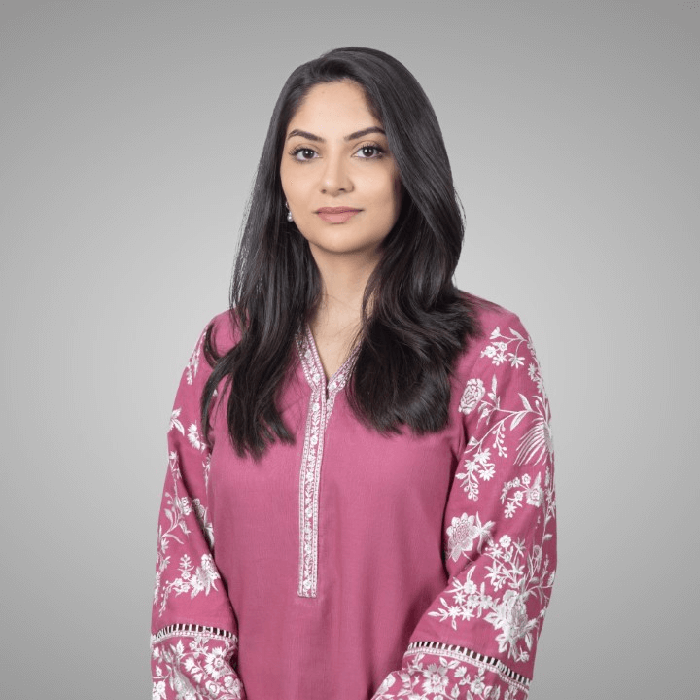

Maham Fatani

Analyst

Karachi, Pakistan

Maham has a Bachelors degree in Business Administration (BBA) from SZABIST and is a recipient of the Vice chancellors Honor List due to high academic merit. After graduation, she Joined Bridge Factor as a Financial Analyst where she is engaged in in financial modelling, preparation of feasibility reports, and tariff true-ups for renewable energy projects. Prior to this, Maham interned at Habib Metropolitan Bank where she working with the teams in various departments including credit, remittance, trade and operations.

SULEMAN ASHRAF

Analyst

Karachi, Pakistan

Suleman has over 4 years of experience of working as a sell-side equity analyst where he predominantly covered autos, fertilizers and chemical sectors

Suleman has over 4 years of experience of working as a sell-side equity analyst where he predominantly covered autos, fertilizers and chemical sectors. He joined Bridge Factor in 2021 and is involved in various transactions, developing financial models for project finance and corporate finance deals. Prior to joining Bridge Factor he worked in Next Capital Limited and IGI Finex Securities (Pvt. Ltd) as an Investment Analyst. He has Bachelor's in Industrial and Manufacturing Engineering from NUST and has completed MBA from Karachi School Of Business & Leadership (KSBL).

MS. Sidra

HR Manager & Coordinator

Islamabad, Pakistan

Human Resource Management, Organizational Development.

Young, energetic & competent, Sidra has an extensive knowledge in HR, having previously worked for some of the finest industries. With more than two years of experience in dealing with Administration and Human Resource operation at Bridge Factor, She is trusted among her network for her honesty, reliability and positive-oriented approach. Combining a pro-active attitude with a strong professional work ethics, Sidra keeps abreast of the multiple tasks and the most up-to-date market trends. Sidra is also very proficient in effectively managing administrative & HR operations. She has been involved in recruitment & selection, employee orientation, doing needs assessments, developing employee relations & developing all the processes & metrics that supports the achievement of the Organization’s goals & objectives. Sidra is currently pursuing her MS Degree from a well reputed Business School.

sidra@bridgefactor.com